Financial strength is crucial for companies because it directly impacts their ability to weather economic downturns, pursue growth opportunities, and provide returns to investors. For analysing the financial health of the company we have such a metric which helps us in determining the whether company is financially sound or weak. This metric is called the Piotroski Score. Let’s find out what is it and how it helps us in picking financially sound companies for investment.

Table of Contents

ToggleWhat is Piotroski Score?

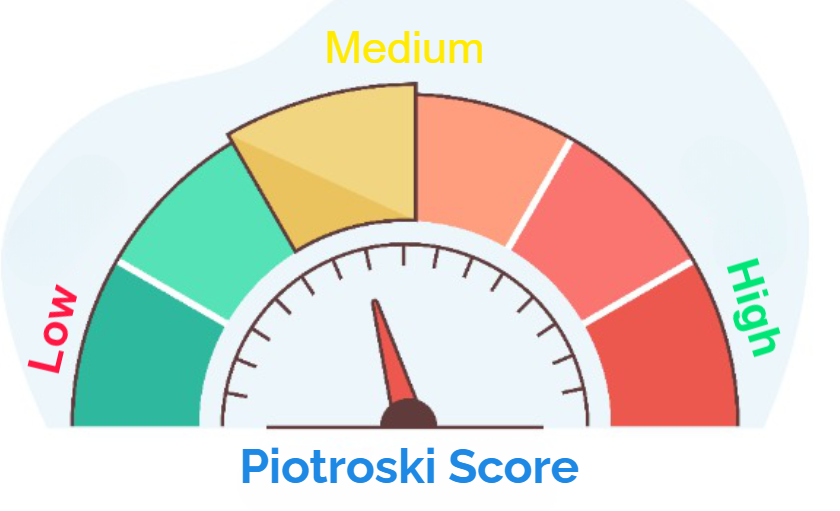

The Piotroski Score is a nine-point scoring system developed by Professor Joseph Piotroski of Stanford University. This scoring system is designed to evaluate the financial strength and stability of a company. It ranks companies on a scale of zero to nine, with nine being the best score. A company with a high Piotroski Score of eight or nine is typically considered to be financially sound, while a low score of one or two indicates a weak financial position. The score is an important tool for investors who want to make sure the company they are investing in is financially sound.

How to calculate Piotroski Score?

The Piotroski score is used to evaluate the financial strength of a company. The score assigns points for nine different criteria and ranges from 0 to 9. Each criterion must be met in order for a company to receive a point, with higher scores indicating a stronger financial position. All nine criteria fall into below three categories.

- Profitability

- Leverage, Liquidity, and Source of Funds

- Operating Efficiency

Understanding the terms

- Net Income: The net income of a business is its total revenues minus its total expenses. It is the amount that is left over after all costs and expenses have been paid. It is the amount of money the company keeps for itself after all the other obligations have been met. It is also referred to as the bottom line.

- Return on Assets: Return on Assets (ROA) is a financial ratio that measures the profitability of a company in relation to its total assets. It is calculated by dividing a company’s net income by its total assets. A higher ROA indicates that the company is more profitable and is generating more income from its assets.

- Operating Cash Flow: Operating cash flow (OCF) is a measure of a company’s liquidity. It is the amount of cash generated by the company’s primary operating activities. It is calculated by subtracting the company’s operating expenses from its operating revenue.

- Gross Margin: Gross margin is a profitability measure that calculates the percentage of revenue that remains after accounting for the cost of goods sold (COGS). It is calculated by subtracting the cost of goods sold from total revenue and dividing by total revenue.

- Leverage Ratio: The leverage ratio is a measure of a company’s financial leverage. It is calculated by dividing a company’s total debt by its total assets. A higher leverage ratio indicates that the company is more highly leveraged and is taking on more risk.

- Asset Turnover: Asset turnover is a financial ratio that measures a company’s efficiency in utilizing its assets to generate sales. It is calculated by dividing total sales by total assets.

- Leverage Ratio: Leverage ratio is a financial ratio that measures a company’s ability to meet its financial obligations. It is calculated by dividing total liabilities by total assets.

- Current Ratio: Current ratio is a financial ratio that measures a company’s ability to pay its short-term obligations. It is calculated by dividing current assets by current liabilities.

- Shares Outstanding: Shares outstanding is the number of shares of a company that are currently held by investors, including restricted shares owned by the company’s officers and insiders as well as those held by the public.

Profitability Criteria

- Net Income: 1 if there is a positive net income, 0 otherwise.

- Return on Asset (ROA): 1 if ROA is higher than the prior year, 0 otherwise.

- Cash Flow: Positive operating cash flow in the current year (1 point)

- Quality of Earnings: Cash flow from operations being greater than net Income (quality of earnings) (1 point)

Leverage, Liquidity, and Source of Funds

- Change in Leverage: 1 if the company’s debt ratio is lower than the highest debt ratio over the past 2 years, 0 otherwise

- Current Ratio: 1 if the company’s current ratio is higher than the lowest ratio over the past 2 years, 0 otherwise

- Shareholders Equity: 1 if the company’s shareholders equity is higher than the lowest value over the past 2 years, 0 otherwise

Operating Efficiency :

- Gross Margin: A higher gross margin compared to the previous year (1 point)

- Asset Turnover Ratio: A higher asset turnover ratio compared to the previous year (1 point)

Words of Wisdom

“The stock market is designed to transfer money from the active to the patient.” — Warren Buffett

Key Takeaways

- Piotroski Score is a tool used to measure the financial health of a company. It looks at nine factors to determine a company’s financial strength.

- The nine factors are: net income, return on assets, operating cash flow, change in gross margin, change in asset turnover, leverage ratio, Change in current ratio, net income, and change in shares outstanding.

- A high Piotroski Score(7-9) indicates a company is likely to be financially healthy and stable.

- Companies with a low Piotroski Score(0-2) may be at risk for financial distress and should be monitored closely.

- Investors should use the Piotroski Score in conjunction with other metrics to properly assess a company’s financial health.

Conclusion

The Piotroski F-score is an important tool for investors to assess the financial health of a company and its potential for long-term growth. It is based on a set of nine criteria, which focus on the profitability and financial strength of a company. Companies that score higher than 8 on the F-score are considered to be financially strong and likely to outperform the market in the long term. Companies that score lower than 8 are considered to be weaker and may be more susceptible to market volatility and financial distress. The Piotroski F-score is a valuable tool for investors to use and can be an important part of a sound investment strategy.

Thank you for taking the time to read this blog post! I hope you found the information helpful and informative. If you have any thoughts or feedback, I’d love to hear from you in the comments section below. You can also follow me on social media to stay up to date with my latest posts and updates.