Direct stock investing is sometimes daunting because a lot of effort needed from the investor side. Investors need to do a lot of research before investing. There are some products which help the investor in investing in equity markets without doing much research, one such product is the mutual fund. Mutual funds are considered a popular investment option for various reasons, particularly for those looking to invest in the stock market.

In this article, we will discuss some dos and don’ts of investing in mutual funds.

Table of Contents

ToggleWhat are Mutual Funds?

Mutual funds are a type of professionally managed investment vehicle that pools money from many investors to purchase a variety of securities, such as stocks, bonds, and other investments. The fund’s goal is to generate returns for its investors by diversifying across asset classes and markets while providing diversification, liquidity, and professional management.

Types of Mutual funds

- Stock Funds: These funds invest primarily in stocks, making them most suitable for investors with a higher tolerance for risk.

- Bond Funds: These funds invest primarily in bonds, making them attractive to more conservative investors.

- Money Market Funds: These funds invest in short-term debt instruments and are generally very low-risk.

- Index Funds: These funds buy and hold a basket of stocks designed to track a specific market index.

- Balanced Funds: These funds invest in a combination of stocks, bonds, and other asset classes to provide both growth and income.

- Specialty Funds: These funds invest in a wide variety of asset classes, such as real estate, commodities, or international securities.

Do These Things Before Investing in Mutual Fund

- Understand Your Goals: Before you decide to invest in mutual funds, take some time to think about your long–term financial goals and the amount of risk you‘re comfortable taking on. Your goals should determine the type of funds you choose and how long you plan to invest.

- Understand Your Risk Tolerance: Evaluate your risk tolerance by thinking about how you‘d feel if you experienced a 10% decline in the value of your mutual fund investment. Are you comfortable with that amount of risk or would the volatility make you too anxious?

- Research Fund Managers and Funds: Research the funds and fund managers you‘re considering investing in to get a better understanding of their track record, fees, and investment strategy. You should also check the rating of funds provided by various rating agencies such as CRISIL, ICRA and CARE.

- Look for Low Expense Ratios: Mutual funds charge fees and expenses, so it‘s important to look for funds with low expense ratios. The lower the expense ratio, the more of your money is invested in the fund and the more money you could potentially make.

- Diversify Your Portfolio: Diversification means investing in multiple types of investments, in different sectors and asset classes, in order to spread the risk across a variety of investments. This can help reduce risk and optimize potential returns.

- Beating Benchmark: You also check whether the fund you are considering investing in is beating the benchmark or not.

- Be Patient: Investing in mutual funds is a long–term strategy, so be patient and allow investments time to grow. Don‘t get too caught up in short–term performance. Focus on your long–term financial goals.

Pros of investing in Mutual funds

- Professional Management: Mutual funds are managed by professional fund managers who are experts in analyzing market trends and making investment decisions. The fund managers have access to research and analysis that is not available to the individual investor.

- Diversification: Mutual funds allow investors to diversify their portfolios and spread their risk across a variety of asset classes. By investing in a mutual fund, investors can benefit from the expertise of the fund manager in selecting a diverse set of securities.

- Lower Investment Costs: Mutual funds typically have lower expense ratios than individual stocks, which can result in lower investment costs for the investor.

- Liquidity: Mutual funds are generally easy to buy and sell, which makes them a good choice for investors who need access to their money.

Cons of investing in Mutual funds

- Professional Management: The fund manager is responsible for making decisions about where to invest the money in the fund, so the investor is entrusting their money to the judgement of the fund manager.

- Risk: Mutual funds are subject to market risk and can lose value.

- Fees and Expenses: Mutual funds charge fees and expenses that can reduce returns.

- Lack of Control: Investors in mutual funds don’t have control over the specific investments in the fund, which limits their ability to tailor the fund to their own investment objectives.

The Parameters Which Will Help You in Picking a Better Mutual Fund

Past performance: We invest in Mutual funds to gain higher returns than the benchmark index, so it becomes very important to select the fund carefully and the first step in this process is to check the past performance and consistency of that particular fund. An investor can check annual, trailing and rolling returns.

The weighted average price-to-earning (P/E) ratio is calculated by taking the price-to-earnings ratio of each security and multiplying it by its corresponding weight within the portfolio. It will tell whether you have premium valuation stocks(High PE stocks) in your mutual fund holding or not. If this number is on the lower side then your fund manager is investing in value-oriented companies. If this number is on the higher side then your fund manager is investing in growth-oriented companies.

The weighted average price-to-book (P/B) ratio is calculated by taking the price-to-book ratio of each security and multiplying it by its corresponding weight within the portfolio. The high P/B ratio means the fund manager is investing those stocks whose price is high relative to the value of its underlying assets(do not confuse it with the expenses ratio of the fund).

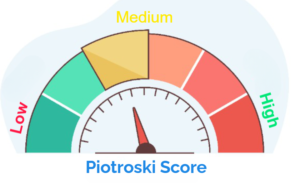

- Alpha is a measure of a mutual fund’s performance relative to a benchmark index. It measures the excess return of a fund relative to the return of the benchmark index. It is typically used to measure the performance of an actively managed fund compared to a passive index fund. If alpha is 1, it means the stock has outperformed the benchmark by 1% and -1 means the stock has underperformed by 1%.

- Beta is a measure of a mutual fund’s volatility, or risk, relative to the overall stock market. A beta of 1.0 means that a fund has the same volatility as the stock market, while a higher beta indicates more volatility and a lower beta indicates less volatility.

- The Sharpe ratio is a measure of risk-adjusted return, calculated by subtracting the risk-free rate from the returns of a mutual fund and dividing it by the standard deviation of those returns. It is a measure of how much excess return a mutual fund provides per unit of risk taken.

- Turnover ratio: It is a measure that indicates the frequency with which the fund’s portfolio holdings are bought and sold within a given period, typically on an annual basis. It is calculated by dividing the purchases and sales of securities by the average net assets of the fund. The turnover ratio is expressed as a percentage.

A higher turnover ratio indicates that the fund’s portfolio is subject to more frequent trading activity, leading to a higher rate of buying and selling securities. Conversely, a lower turnover ratio suggests less frequent trading.

Words of Wisdom

“Follow your passion; it will lead you to your purpose.” — Oprah Winfrey

Conclusion

Investing in mutual funds can be a great way to diversify your portfolio and build wealth over time. By investing in a wide variety of assets, mutual funds offer an easy and convenient way to access the markets and achieve long-term financial goals. Additionally, mutual funds may provide an opportunity to invest in assets that may be difficult to access on an individual basis. Before investing, it is important to understand the fees and risks associated with mutual funds and to ensure that the fund is a suitable investment for your unique needs and goals. With the right research and a commitment to long-term investing, mutual funds can be an excellent way to build and manage a portfolio.